Apr 18, 2024

What you need to know about comprehensive insurance for your car

Comprehensive insurance is one of the many different types of coverage you can add to your policy - it is not part of mandatory Ontario auto insurance. It protects your vehicle from risks unrelated to a collision, such as fire, theft, vandalism and weather.

For example, if your vehicle was stolen, then later found and returned to you, you could submit a car insurance claim to cover the cost of repairs.

This blog will explain this type of insurance, how much it costs, and when you need it.

Three main takeaways about comprehensive insurance for your car:

- Comprehensive insurance covers repairs to your vehicle from non-collision events such as theft, natural disasters, animals, falling trees, and vandalism. It doesn't include damage to other people or vehicles.

- Purchasing comprehensive coverage may not be cost-effective for an older vehicle that has depreciated significantly, but you may need it if you lease.

- You can increase your comprehensive insurance deductibles to reduce your premium costs.

What’s on this page

What is comprehensive insurance?What does comprehensive insurance cover in Ontario?

What does comprehensive insurance not cover?

Should you have comprehensive car insurance?

How does comprehensive insurance work?

How does comprehensive insurance work for claims?

What is my comprehensive insurance limit?

What’s the difference between comprehensive and third party insurance?

When should you consider dropping comprehensive insurance?

Is comprehensive insurance the same as full coverage?

Do you need collision and comprehensive insurance?

Does your comprehensive insurance cover you while driving another person's car?

Comprehensive insurance FAQs

What is comprehensive insurance?

Comprehensive insurance provides additional protection not included in basic automobile policies - it goes above and beyond the minimum requirements. It gives assurance against non-collision related threats, such as vandalism or you need to submit a claim for your car being stolen.

Comprehensive coverage does not cover medical expenses, legal fees, or lost income from an accident.

Is comprehensive insurance mandatory?

Comprehensive insurance is an optional form of insurance you can add to your policy. In this case, it’s similar to all perils or specified perils and optional policy endorsements (OPCFs). It’s extra protection added to your basic coverage.

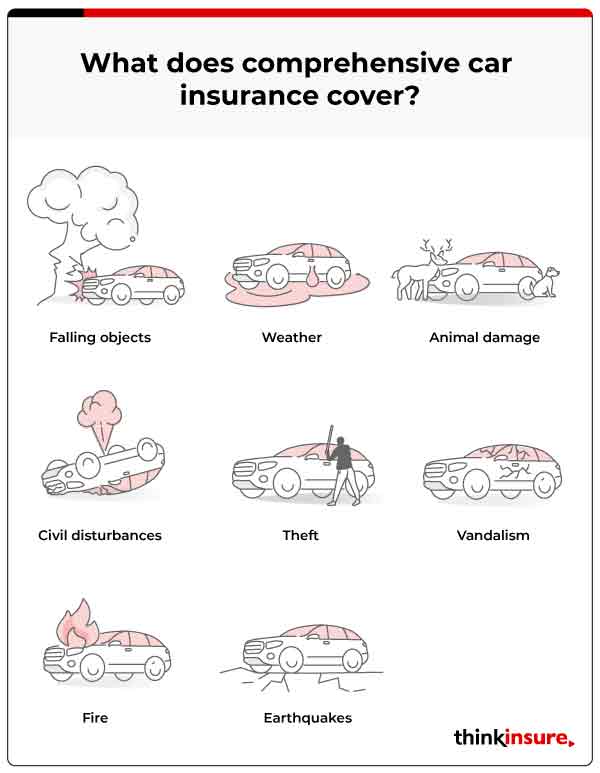

What does comprehensive insurance cover in Ontario?

One of the most important aspects of comprehensive coverage, is understanding what it can cover.

“This coverage pays for losses, other than those covered by collision or upset, including perils or dangers listed under Specified Perils, falling or flying objects, missiles and vandalism,” says FSCO.

Here is what it includes:

- Natural disasters and weather

- Fire damage and explosions

- Civil disturbances

- Vandalism and theft

- Damage from collision with wildlife

- Broken or shattered windows and cracked windshield

- Falling objects

What does comprehensive insurance not cover?

Comprehensive policies may not cover certain things. Comprehensive does not mean everything. These items are excluded from the policy.

- Medical expenses or loss of income after an accident.

- Damage to another driver’s vehicle as a result of an accident.

- Medical expenses or lost income for another person after an accident.

- Theft by a member of your household.

- Rental car accident after filing a claim.

- Personal items stolen from your car.

Should you have comprehensive car insurance?

When comparing options, it’s important to determine whether comprehensive meets your needs. Some people opt not to have it to lower the costs of their coverage.

However, you are also reducing your amount of protection. Depending on the cause of the damage, you may be on the hook for the repairs. Note that you may need to have it if you have a loan on the vehicle.

Consider these important questions when determining your needs:

- Peace of mind: Is the extra amount added to your premium worth the peace of mind?

- Financial situation: Are you able to pay out of pocket for repairs if you choose against it?

- Vehicle value: Many owners of older vehicles don't add this type of because of the lower vehicle value.

- Risk: Do you think there is risk or chance that you will need to make a claim?

- Car loan: Do you have a car loan? If so, your lender will likely want you to have comprehensive insurance.

Expect comprehensive protection to add a few hundred dollars to your Ontario car insurance quote. This will vary based on where you live, your insurer, driving history.

How does comprehensive insurance work?

In Ontario, you can add comprehensive insurance to your auto insurance policy. This coverage provides financial protection for damages to your vehicle that are not caused by a collision.

For instance, let's say you park your car on the street overnight, and a severe storm hits the area. Comprehensive insurance will cover the repair costs if a large tree limb falls on your car, causing significant damage to the roof and windshield.

Without comprehensive insurance: You'd pay out of pocket for car damage, which can cost thousands, depending on the extent.

With comprehensive insurance: If you have comprehensive coverage, file a claim with your insurance company. Once they assess the damage, they'll cover the cost of repairs minus your deductible.

The specific terms and conditions of comprehensive coverage may vary depending on the insurance provider and your policy details. In this example, having comprehensive insurance would save you from paying for the repairs yourself as long as your policy covers the damage.

How does comprehensive insurance work for claims?

A comprehensive insurance claim is similar to a standard auto insurance claim. The only difference is what you are claiming and your deductible amount.

Most policies include a $300 or $500 deductible. You can increase your amount, which will help lower the cost. You only need to pay your deductible for claims that fall under comprehensive.

For example, there is a bad storm, and a tree branch falls on your car while parked. The damages amounted to $2000, but you had a $500 deductible. Therefore, you will pay the $500 and your provider will cover $1500.

What is my comprehensive insurance limit?

Comprehensive is subject to a coverage limit (the most your policy will pay out). This amount is different depending on your policy options and insurer. Claims made are subject to these limits.

What’s the difference between comprehensive and third party insurance?

Comprehensive and third party liability are different types of policies, but it is recommended to have both. Third party coverage is mandatory - it covers you if you are at-fault for an accident that results in damage or injury. Comprehensive is an optional addition.

When should you consider dropping comprehensive insurance?

Many people consider dropping the comprehensive as their car ages. It’s a quick way to save money on your plan. Vehicles depreciate at different rates, so it depends on your current situation.

Consider the value of your car against your policy costs and financial situation. Speak with your insurer to learn about your options.

Is comprehensive insurance the same as full coverage?

Full automobile insurance is something people refer to when they have all types of coverage. This means you have comprehensive, collision, and other optional policies.

Do you need collision and comprehensive insurance?

There is often confusion between collision insurance and comprehensive insurance, as both provide coverage for car damage. However, they protect you from different types of damage. You have the option to purchase either one or both types of coverage.

Comprehensive policies cover more sources of damage to your vehicle than collision insurance.

If you have an older vehicle, then collision may not be in your best interests. You may want something else if you want to pay as little as possible. It all comes down to your risk tolerance and ability to cover costs if you experience damage.

For many drivers, having both types provides them with peace of mind. You’ll have financial protection from the majority of threats to your vehicle.

Does your comprehensive insurance cover you while driving another person's car?

To know if your insurance covers someone else driving your car, it depends on your insurance. It’s important to check with your insurer to get clarification. Many companies now offer driving other cars (DOC), or occasional driver coverage, under a full comprehensive policy.

Comprehensive insurance FAQs

It depends. Coverage limits, car value, age, and other factors affect costs. Expect to pay a few hundred dollars extra to add comprehensive coverage. Find out for sure by contacting us today.

If you lease or finance your vehicle, you will most likely need comprehensive coverage, which will be part of your lease or finance agreement.

No. Insurance for a rental car is available by adding policy endorsement OPCF 20.

Comprehensive may cover you for damage to your vehicle from rodents and animals. Check your policy and speak with your insurer to confirm.

Get Added Protection With Comprehensive Insurance

Find out if your auto insurance has comprehensive coverage by checking your policy. If you do, your policy documents will outline the limits, deductible, and other key information. If you aren’t sure, you can contact us to learn more.