How do I get cheap car insurance in Windsor?

For starters, you need to drive safely, avoid accidents, and stay claims-free. At a minimum, this will prevent you from seeing rates increase because of your driving behaviours.

But finding cheaper rates for car insurance in Windsor is about more than just driving safely. With so many insurers to choose from, you are doing yourself a disservice if you do not check quotes from multiple companies. Exploring your options enables you to take advantage of discounts, find savings opportunities, and choose the right insurance for you.

How much does car insurance in Windsor cost?

Car insurance in Windsor costs approximately $ 2,280 per year. This is about $ 500 higher compared to the provincial average for Ontario car insurance. Shop around with our brokers to ensure you get the best premiums and coverage.

Here’s a breakdown of how much you can expect to pay:

- Annually: $ 2,280

- Semi-annually: $ 1,140

- Quarterly: $ 570

- Monthly: $ 190

- Weekly: $ 43.84

- Daily: $ 6.24

Rates are based on ThinkInsure customer quote data for Q1 2024 (Jan 1 to March 15, 2024)

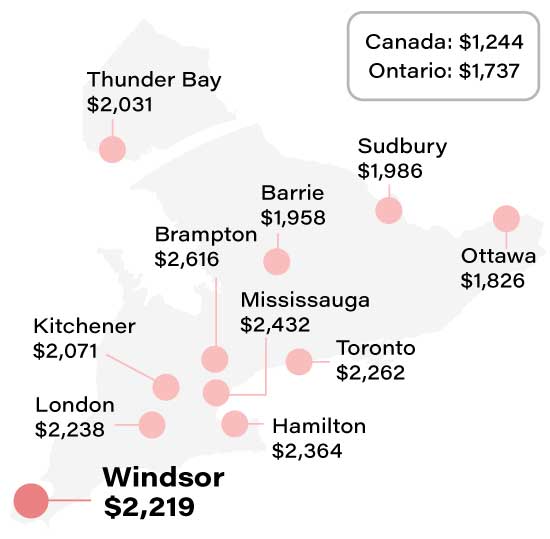

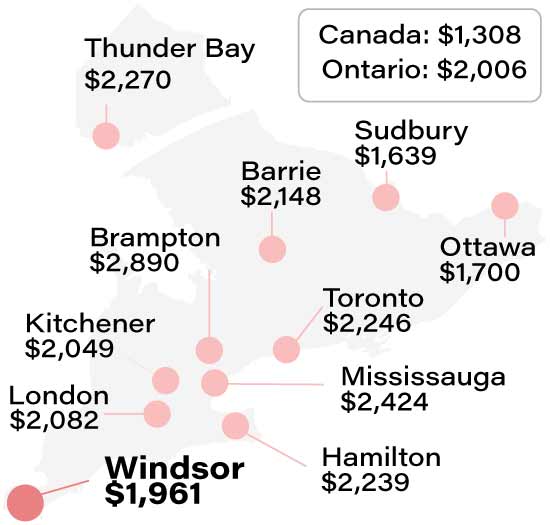

Windsor car insurance premium map

Sources: *FSRAO

2023 ThinkInsure customer quote data. Drivers with a clean driving record and standard coverage

Windsor car insurance rates from 2019-2024

Premiums are trending upward again. Insurance rates are subject to frequent change. Insurers rely on collected data regarding claims, repair costs, accidents, and several other factors to determine these changes. Your driving history and potential eligibility for supplementary discounts further contribute to these rate adjustments.

Case in point, premiums in Windsor differ by year. Post-pandemic rates have increased more than in previous years. Here is a breakdown from 2019 to 2024:

| Year |

Average annual premium |

| 2024 |

$ 2,280 |

| 2023 |

$ 2,219 |

| 2022 |

$ 1,922 |

| 2021 |

$ 1,891 |

| 2020 |

$ 1,927 |

| 2019 |

$ 1,939 |

| Average rate (2019-24) |

$ 2,030 |

**

Windsor auto insurance premiums by driver type

Your auto insurance payments are impacted by your driver classification. Elements like age, demographics, driver classification, and driving record are taken into account by insurance providers when establishing your premiums. To assess how these factors affect your payments, we examined our Windsor customer quote data. Here's what we uncovered:

- Mature drivers pay more than 20% less and younger drivers pay about 40% more.

- People in the high risk category pay close to 200% more for coverage.

- Men and women pay about the same in Windsor. However, single individuals pay more than $200 per year more than married individuals.

- Accidents and tickets hurt the pocketbook. Expect an increase of close to 30%.

| |

Premium |

Monthly |

Difference |

| Driver type |

| All drivers |

$ 1,920 |

$ 160 |

0 |

| Young drivers (25 and under) |

$ 2,685 |

$ 224 |

39.84% |

| Middle age (25 - 50) |

$ 1,967 |

$ 164 |

2.45% |

| Mature/senior drivers (50+) |

$ 1,511 |

$ 126 |

- 21.30% |

| High risk drivers |

$ 5,620 |

$ 468 |

192.71% |

| Demographics |

| Male |

$ 1,901 |

$ 158 |

- 0.99% |

| Female |

$ 2,041 |

$ 170 |

6.30% |

| Married |

$ 1,815 |

$ 151 |

- 5.47% |

| Single |

$ 2,075 |

$ 173 |

8.07% |

| Driving record |

| Clean driving record |

$ 1,920 |

$ 160 |

0 |

| 1 ticket within the past 3 years |

$ 1,971 |

$ 164 |

2.66% |

| 1 accident in 3 years |

$ 2,467 |

$ 206 |

28.49% |

| 1 cancellation in 3 years |

$ 2,267 |

$ 189 |

18.07% |

| 1 suspension in 3 years |

$ 2,298 |

$ 192 |

19.69% |

***

Auto insurance rates in Windsor compared to local cities nearby

As one of the larger cities in the region, residents in Windsor typically pay more than neighbouring communities.

| City |

Avg premium |

| Tecumseh |

$ 1,944 |

| Windsor |

$ 1,920 |

| Leamington |

$ 1,782 |

| Essex |

$ 1,608 |

| Belle River |

$ 1,537 |

| Chatham |

$ 1,503 |

| LaSalle |

$ 1,501 |

| Tilbury |

$ 1,458 |

****

What areas in Windsor have the cheapest car insurance?

Your insurance costs can be influenced by the area you live in within a city. In Windsor, the difference between postal codes could result in hundreds of dollars difference annually. For example, postal code N9J has the most affordable rates and N9B is the most expensive.

| Area in City of Windsor |

Postal Codes |

Avg Premium |

| Tecumseh |

N8N |

$ 1,946 |

| East Riverside |

N8P |

$ 1,653 |

| East Forest Glade |

N8R |

$ 1,914 |

| Riverside |

N8S |

$ 1,763 |

| West Forest Glade, East Fontainbleu |

N8T |

$ 1,877 |

| Walkerville, South Walkerville, Devonshire Heights, Walker Farm, Fontainebleau |

N8W |

$ 1,812 |

| South Central, West Walkerville, Remington Park |

N8X |

$ 2,161 |

| East Windsor, East Walkerville |

N8Y |

$ 2,063 |

| City Centre |

N9A |

$ 2,016 |

| Bridgeview, South Cameron |

N9B |

$ 2,196 |

| Sandwich, Ojibway, West Malden |

N9C |

$ 2,101 |

| South Windsor |

N9E |

$ 1,848 |

| Roseland |

N9G |

$ 1,831 |

| East Windsor, LaSalle |

N9H |

$ 1,784 |

| West Windsor, LaSalle |

N9J |

$ 1,644 |

| Windsor |

N9K |

$ 1,944 |

***

Windsor car insurance premiums by vehicle brand

The type of car you drive can impact your premiums by hundreds of dollars. See how the brand affects insurance in Windsor:

| Vehicle brand |

Premium |

Monthly payment |

| Honda |

$ 1,616 |

$ 135 |

| Toyota |

$ 1,524 |

$ 127 |

| Ford |

$ 2,151 |

$ 179 |

| Kia |

$ 2,361 |

$ 197 |

| Lexus |

$ 1,376 |

$ 115 |

| Chevrolet |

$ 2,578 |

$ 215 |

| RAM |

$ 1,913 |

$ 159 |

| Dodge |

$1,913 |

$159 |

| Jeep |

$ 2,326 |

$ 194 |

| Subaru |

$ 1,687 |

$ 141 |

| Mazda |

$ 1,636 |

$ 136 |

| Nissan |

$ 1,469 |

$ 122 |

| Volkswagen |

$ 1,548 |

$ 129 |

| Mercedes |

$ 2,525 |

$ 210 |

| BMW |

$ 3,190 |

$ 266 |

***