How much does St. Catharines car insurance cost?

Car insurance rates in St. Catharines are more than the provincial average. Drivers can expect to pay about $2,067 annually for their policy. This is more affordable than many other areas in the region, such as Hamilton and Mississauga.

Here’s a breakdown of how much you can expect to pay:

- Annually: $2,067

- Semi-annually: $1,033.50

- Quarterly: $516.75

- Monthly: $172.25

- Weekly: $39.75

- Daily: $5.66

Rates are based on ThinkInsure customer quote data for Q1 2024 (Jan 1 to March 15, 2024)

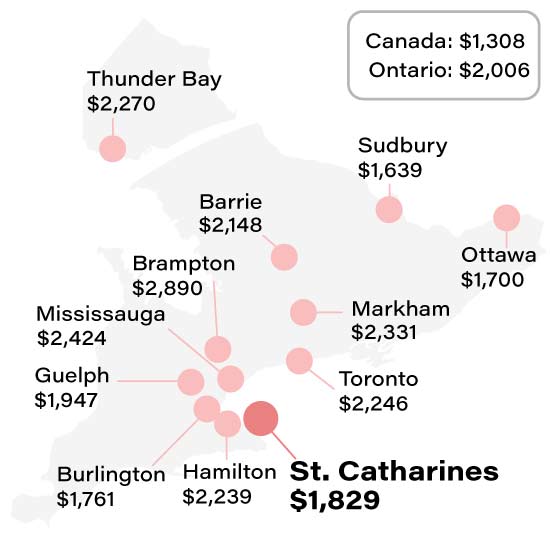

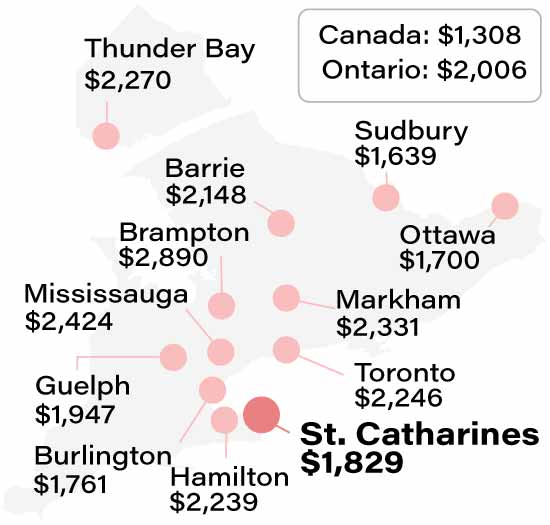

St. Catharines auto insurance premium map

Sources: *FSRAO

2023 ThinkInsure customer quote data. Drivers with a clean driving record and standard coverage

St. Catharines car insurance rates from 2019-2024

Costs are on the rise again. Insurance rates are constantly evolving, with frequent changes based on insurers' examination of data relating to claims, repair costs, accidents, and numerous other factors. Additionally, your driving record and potential eligibility for extra discounts can influence these rate fluctuations. Here’s how rates are changing in St. Catharines:

| Year |

Average annual premium |

| 2024 |

$ 2,067 |

| 2023 |

$ 2,051 |

| 2022 |

$ 1,791 |

| 2021 |

$ 1,646 |

| 2020 |

$ 1,901 |

| 2019 |

$ 2,219 |

| Average rate (2019-24) |

$ 1,946 |

**

St. Catharines auto insurance premiums by driver type

Your auto insurance premiums are impacted by your driver classification. As you can see in the table below, factors such as age, demographics, driver classification, and driving record all play a big role in determining your premiums:

| |

Premium |

Monthly |

Difference |

| Driver type |

| All drivers |

$ 1,953 |

$ 163 |

0 |

| Young drivers (25 and under) |

$ 2,654 |

$ 221 |

35.89% |

| Middle age (25 - 50) |

$ 1,960 |

$ 163 |

0.36% |

| Mature/senior drivers (50+) |

$ 1,357 |

$ 113 |

- 30.52% |

| High risk drivers |

$ 4,672 |

$ 389 |

139.22% |

| Demographics |

| Male |

$ 2,056 |

$ 171 |

5.27% |

| Female |

$ 1,802 |

$ 150 |

- 7.73% |

| Married |

$ 1,732 |

$ 144 |

- 11.32% |

| Single |

$ 2,056 |

$ 171 |

5.27% |

| Driving record |

| Clean driving record |

$ 1,953 |

$ 163 |

0 |

| 1 ticket within the past 3 years |

$ 2,161 |

$ 180 |

10.65% |

| 1 accident in 3 years |

$ 2,462 |

$ 205 |

26.06% |

| 1 cancellation in 3 years |

$ 2,181 |

$ 182 |

11.67% |

| 1 suspension in 3 years |

$ 2,166 |

$ 181 |

10.91% |

*****

Auto insurance rates in St. Catharines compared to local cities nearby

St. Catharines is not as expensive as some cities, but more expensive than others. See how they compare to other local cities nearby:

| City |

Avg premium |

| Hamilton |

$ 2,291 |

| Burlington |

$ 2,002 |

| Brantford |

$ 1,784 |

| St. Catharines |

$ 1,734 |

| Welland |

$ 1,569 |

| Niagara Falls |

$ 1,557 |

| Grimsby |

$ 1,406 |

****

What areas in St. Catharines have the cheapest car insurance?

Where you live within a city can affect the cost of your insurance. In St. Catharines, the disparity between postal codes could mean differences of several hundred dollars annually. If you look at the table below, you can see just how much of a difference postal code can make. The most affordable postal code region is L2S and the most expensive is L2W. There is about a $400 difference between them.

| Area in City of St. Catharines |

Postal Codes |

Avg Premium |

| Western Hill, Grapeview, Vansickle, Martindale Heights |

L2S |

$1,855 |

| Merritton, Secord Woods, Niagara Gardens, Homer, Pot Dalhousie, Lakeshore, Grantham |

L2P, L2N, L2M |

$ 1,930 |

| Central St. Catharines |

L2R |

$ 1,873 |

| South St. Catharines |

L2T |

$ 1,982 |

| Southeast St. Catharines |

L2V |

$ 2,117 |

| West St. Catharines |

L2W |

$ 2,245 |

***