How does Quebec car insurance work?

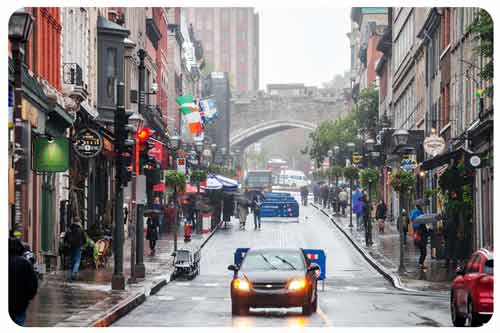

![a car is passing on the road in Quebec City]()

Quebec has used a hybrid auto insurance system since 1978. This system has two main parts – public (section A) and private insurance (section B). Here is what is covered under each section:

Public car insurance in Quebec

Public car insurance is operated by the government agency Société de l'assurance automobile du Québec (SAAQ). They set premiums for your public coverage and provide you with personal injury protection. Your public plan covers your accident benefits. If you were injured in an accident, the province would pay all parties' medical costs, regardless of who is at fault. You are not permitted to sue for damages as a result.

Accident benefits include:

- Medical payments.

- Funeral expenses are capped at $5,377.

- Disability income: 90% of net annual income. This is capped at $76,500 per year.

- Impairment benefits are capped at $382,500.

Private car insurance in Quebec

Private car insurance covers the property damage component of your policy. You can purchase this from private insurance companies who compete for your business. You can choose from a selection of optional solutions and endorsements.

Who regulates auto insurance rates in Quebec?

All insurers in Quebec are part of the Groupement des assureurs automobiles (GAA). They regulate pricing in the province using two tools:

- The Automobile Statistical Plan: They assess the previous year’s premiums and claims to calculate the rate insurance companies should charge. If claims are higher than premiums, rates will increase.

- The Fichier central des sinistres automobiles: This is a record of claims and accidents for drivers. GAA and private insurers use this to assess a driver’s risk before offering an estimate.

Does Quebec have no-fault insurance?

Yes. The province operates using a no-fault insurance system. For drivers, you deal with your own insurance company after an accident. It does not matter who is at fault.