How does car insurance in Newfoundland work?

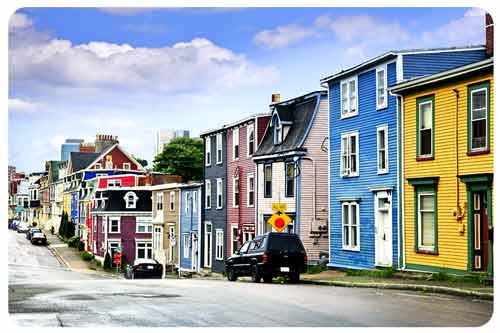

![A car parked on the side of road with colorful houses.]()

The province operates using private insurers. Auto insurance in Newfoundland is available through insurance companies and brokers. Insurance premiums are regulated and set by the Newfoundland and Labrador Board of Commissioners of Public Utilities . They must approve all rate increases before insurers can increase premiums.

The Digital Government and Service NL regulates and helps resolve insurance disputes.

Newfoundland car insurance rules

In Newfoundland and Labrador, you are required to have valid insurance. Car insurance is mandatory. You are required to have a minimum of $200,000 in third-party liability coverage. You will need this to register your automobile. Unlike other provinces, accident benefits are not required. However, it is highly recommended.

The province previously operated using a tort system. As of January 2020, residents now deal with their insurance provider for property damage claims. When it comes to recuperating costs that are outside of your plan, you have the right to sue an at-fault driver for pain and suffering, lost income, and other damages.

Does Newfoundland have no-fault insurance?

The province is unique in the way accident fault claims are dealt with. They operate using a direct compensation model. This is part of a no-fault insurance system. Insurance companies use their method to determine which party is at fault for an accident. However, the province does not have no-fault benefits.

When they are not at fault, drivers with property damage claims work with their insurance provider. The insurer for the at-fault party is responsible for paying out the claim.

Can I get temporary car insurance in Newfoundland?

Temporary insurance is not typically offered in Newfoundland. Some insurance companies will issue 6-month policies. A 12-month policy is the standard offering.