How do I get cheap car insurance in London?

We know saving on car insurance in London is a priority. In addition to working with us to get a quote, here are some effective ways London drivers can get lower car insurance:

- Keep a clean driving record

- Choose an insurance-friendly vehicle

- Increase your deductible

- Bundle car and home insurance

- Park in a garage

- Ask about discounts you may qualify for

- Use winter tires

- Check prices with multiple insurance companies

What is the average car insurance cost in London?

The average cost of car insurance in London is approximately $ 2,222 annually. This is higher than the average car insurance in Ontario and in other areas, but still lower than the GTA. The city has some of the lowest rates compared to other large cities in the province.

Here’s a breakdown of how much you can expect to pay for different time periods:

- Annually: $ 2,222

- Semi-annually: $ 1,111

- Quarterly: $ 555.50

- Monthly: $ 185.16

- Weekly: $ 44.72

- Daily: $ 6.08

Rates are based on ThinkInsure customer quote data for Q1 2024 (Jan 1 to March 15, 2024)

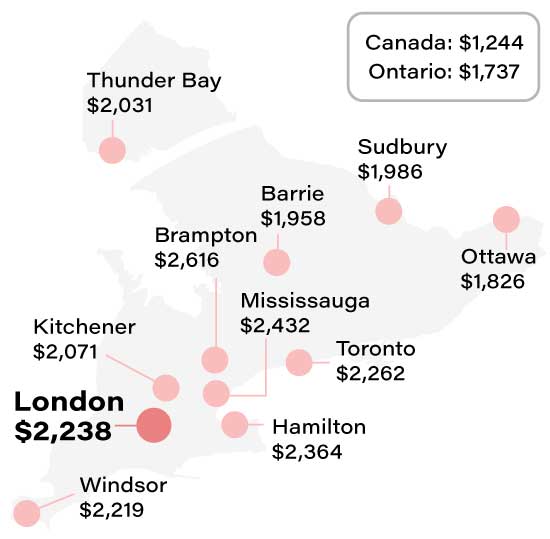

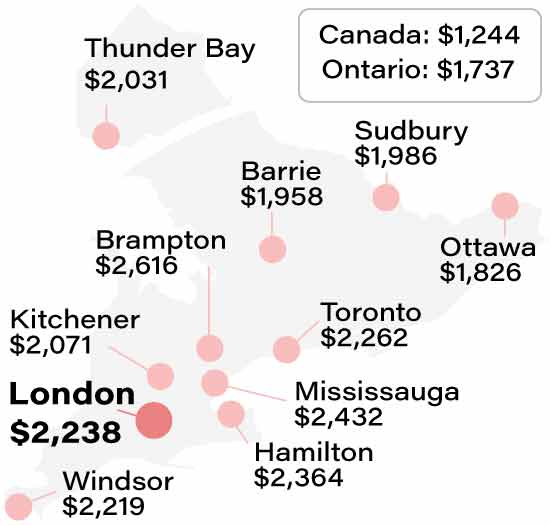

London auto insurance premiums map

Sources: *FSRAO

2023 ThinkInsure customer quote data. Drivers with a clean driving record and standard coverage

London car insurance rates from 2019-2024

Fluctuations in insurance rates occur frequently, as they are determined by insurers using collected data on claims, repair expenses, accidents, and various other factors. Your driving history and eligibility for additional discounts also play a role in the changes observed. In the case of London, costs decreased during the pandemic, but are on the rise once again. Premiums decreased by 0.7% from 2023 to the first quarter of 2024.

| Year |

Average annual premium |

| 2024 |

$ 2,222 |

| 2023 |

$ 2,238 |

| 2022 |

$ 1,924 |

| 2021 |

$ 1,761 |

| 2020 |

$ 2,143 |

| 2019 |

$ 2,107 |

| Average rate (2019-24) |

$ 2,066 |

**

London auto insurance premiums by driver type

How much you pay for auto insurance is dependent on your driver classification. Factors like age, demographics, driver classification, and driving record are taken into account by insurance companies to set your premiums. To assess the influence of these factors on your payments, we analyzed our customer quote data. This is what we observed:

- Young drivers pay 46% more and mature drivers pay 27% less than the median cost.

- High risk drivers pay almost 200% more than standard drivers.

- Men pay more than women and single people pay less than married couples.

- Getting a ticket or being in a collision will increase your rates by 25% or more.

| |

Premium |

Monthly |

Difference |

| Driver type |

| All drivers |

$ 1,970 |

$ 164 |

0 |

| Young drivers (25 and under) |

$ 2,888 |

$ 241 |

46.60% |

| Middle age (25 - 50) |

$ 2,168 |

$ 181 |

10.05% |

| Mature/senior drivers (50+) |

$ 1,435 |

$ 120 |

-27.16% |

| High risk drivers |

$ 5,892 |

$ 491 |

199.09% |

| Demographics |

| Male |

$ 2,016 |

$ 168 |

2.34% |

| Female |

$ 1,905 |

$ 159 |

-3.30% |

| Married |

$ 1,683 |

$ 140 |

-14.57% |

| Single |

$ 2,076 |

$ 173 |

5.38% |

| Driving record |

| Clean driving record |

$ 1,970 |

$ 164 |

0 |

| 1 ticket within the past 3 years |

$ 2,294 |

$ 191 |

16.45% |

| 1 accident in 3 years |

$ 2,484 |

$ 207 |

26.09% |

| 1 cancellation in 3 years |

$ 2,431 |

$ 203 |

23.40% |

| 1 suspension in 3 years |

$ 2,459 |

$ 205 |

24.82% |

*****

Auto insurance rates in London compared to local cities nearby

London typically has more expensive rates than other local cities nearby. This generally has to do with the fact that the city is much larger and has more traffic. See the differences here:

| City |

Avg premium |

| St. Thomas |

$ 2,005 |

| London |

$ 1,970 |

| Chatham |

$ 1,830 |

| Woodstock |

$ 1,779 |

| Strathroy |

$ 1,698 |

| Tillsonburg |

$ 1,686 |

| Sarnia |

$ 1,502 |

****

What areas in London have the cheapest car insurance?

The area you reside in within a city can have an influence on your insurance expenses. In London, the postal code can impact your premiums. Here is a breakdown of premiums by postal code:

| Area in City of London |

Postal Codes |

Avg Premium |

| East London |

N5W |

$ 1,801 |

| Carling |

N5Y |

$ 2,056 |

| Fanshawe, Stoneybrook, Northcrest, Uplands |

N5X |

$ 1,874 |

| North London |

N6A |

$ 1,992 |

| Central London |

N6B |

$ 1,300 |

| South London |

N6C |

$ 1,922 |

| London West |

N6H |

$ 2,226 |

| Byron |

N6K |

$ 2,407 |

***

London car insurance premiums by vehicle brand

Your car brand is a big factor to consider when comparing insurance premiums. Based on our consumer data, premiums can fluctuate by more than $1000. Here are rates by brand for Londoners:

| Vehicle brand |

Premium |

Monthly payment |

| Honda |

$1,897 |

$158 |

| Toyota |

$ 1,876 |

$ 156 |

| Ford |

$ 2,258 |

$ 188 |

| Hyundai |

$ 1,728 |

$ 144 |

| Kia |

$ 2,176 |

$ 181 |

| GMC |

$ 1,527 |

$ 127 |

| Chevrolet |

$ 2,390 |

$ 199 |

| RAM |

$ 1,784 |

$ 149 |

| Dodge |

$ 1,784 |

$ 149 |

| Jeep |

$ 2,003 |

$ 167 |

| Subaru |

$ 1,424 |

$ 119 |

| Mazda |

$ 2,310 |

$ 193 |

| Nissan |

$ 2,303 |

$ 192 |

| Volkswagen |

$ 1,746 |

$ 146 |

| Mercedes |

$ 2,635 |

$ 220 |

| BMW |

$ 2,169 |

$ 181 |

| Tesla |

$ 2,326 |

$ 194 |

| Audi |

$ 3,064 |

$ 255 |

| Lexus |

$ 1,122 |

$ 94 |

***