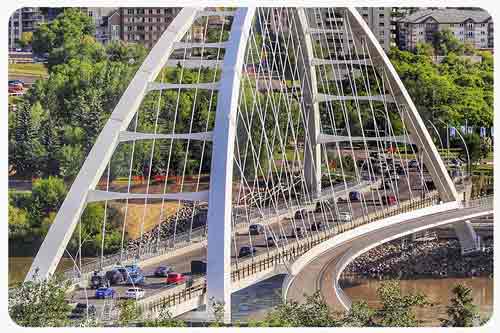

How auto insurance in Edmonton works

All Edmonton residents are required to have car insurance to be able to legally operate a vehicle. The rules and regulations for Alberta car insurance apply. The industry is regulated by the Auto Insurance Rate Board (AIRB). A hybrid no-fault and tort system is in effect. This means you use your insurer no matter who is at fault for the collision. You also have the right to sue other drivers for damages.

Rates are determined using the grid rating system. Car insurance in Edmonton is a combination of mandatory and optional coverage:

Mandatory coverage

All drivers in Edmonton are required to have car insurance. Drivers are required to have a minimum amount of $200,000 in third-party liability. Without this, you will not be able to register your vehicle in the province.

Basic policies also include:

- Personal Liability and Property Damage (PLPD)

- Accident benefits

Optional coverage

You can get optional coverage from any Alberta insurer. Most drivers have more than the minimum requirement of $1 million in third party liability. Many drivers also have collision or comprehensive.

Additional coverage options include:

- Additional PLPD coverage

- Additional accident benefits

- Collision

- Comprehensive

- Specified perils

You also have optional Standard Endorsement Forms (SEF) which allow you to further personalize your plan. Talk with your insurance company about your options.

Grid rating system

Your premium determined using the grid rating system. Most drivers do not pay grid insurance premiums. New drivers and young drivers are often capped by the grid system. This helps them keep costs down.

Tips for better Edmonton car insurance

Getting more than basic car insurance helps Edmonton drivers buy adding extra protection for a variety of different risks. Here are some additional coverages to consider:

- Increase your third-party liability: With Alberta having the highest amount of weather-related claims, it’s important to make sure you have enough liability coverage.

- Get comprehensive for added protection: The rise of vehicle theft and vandalism makes it worth considering getting comprehensive coverage.

- Get windshield coverage: The frigid temperatures, flying stones from trucks, and weather conditions often lead to windshield cracks and the need for replacement.

How much is car insurance in Edmonton?

Edmonton car insurance costs vary from driver to driver. Rates are determined using many factors, including the grid rating system, where you live, age, driving experience, vehicle type, driving record, and even the insurance company you use.

The average cost for auto insurance in Edmonton is about $1,500 per year. This works out to just over $100 per month.

How do I get cheap car insurance in Edmonton?

![red SUV driving in the forest]()

All drivers in Edmonton want to pay less for car insurance. Saving is not as complicated as you think. Here are some ways to find a cheaper rate:

- Shop around: Shop for quotes online or with our insurance experts. See what insurance companies have to offer.

- Drive safe: Keep your driving record clean.

- Choose your vehicle wisely: Choose a vehicle that is insurance friendly.

- Ask about discounts: There are many discounts you could use to lower your payments.

- Use winter tires: You will qualify for a discounted rate.

- Bundle: Combine insurance into the same policy for additional savings.

- Driver training: Completing a driver training program will help new drivers lower premiums.

- Check rates before renewal: Comparing car insurance quotes before you renew allows you to take advantage of cost savings opportunities.