Car Insurance Calculator

Find out how much you can save with our car insurance cost calculator

OR

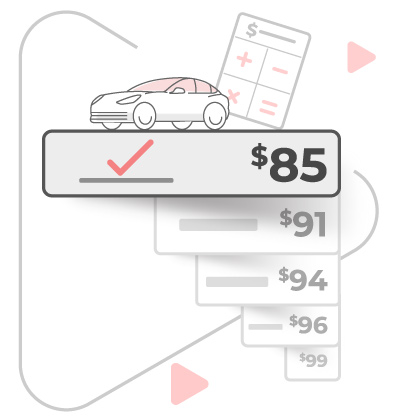

Using a car insurance calculator is an easy way to get an estimate of how much your coverage may cost and help you choose a provider. It allows you to quickly get multiple quotes from the top insurers in Canada at the same time.

To use our auto insurance cost calculator simply provide some basic details about you, your car, driving habits and insurance history. You’ll be able to see multiple estimates and coverage options at once. Using our calcular is quick and it's free to use.

Calculate and compare car insurance quotes in just a couple of minutes.

Enter your postal code and some basic information.

Provide your driving and vehicle information.

Get quotes from the leading companies in Canada.

Using a calculator is a good way to time to find prices from multiple insurers at the same to help you save. Here are some reasons to use a calculator to check premiums:

Using our calculator is easy! Just complete a few simple steps and see free quotes from the leading providers in Canada.

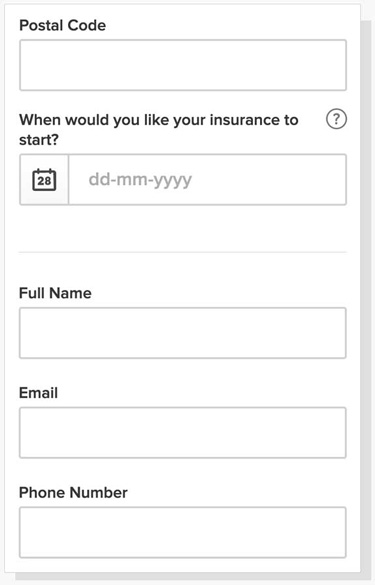

Begin by providing us with your contact information, postal code, and the date when you want your policy to start.

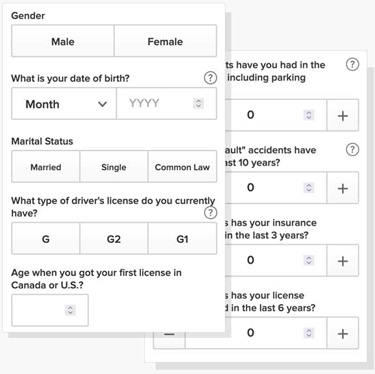

Provide information about the primary driver such as their age, gender, and marital status. Tell us about your driving experience, and how long you have been insured. Then let us know about your driving record such as tickets, accidents, and suspensions.

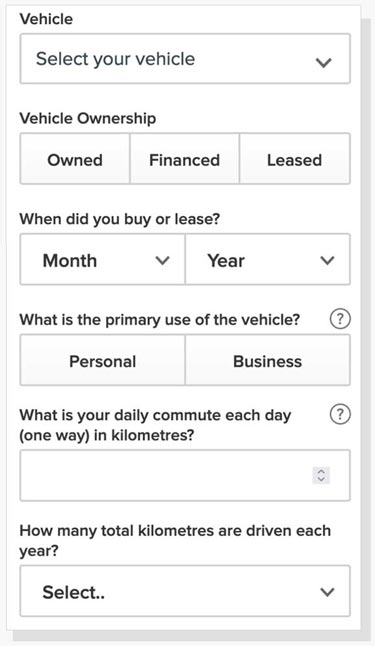

Provide us with information about your vehicle year, make and model. Let us know if you own, finance or lease. Then let us know how you use your vehicle and how much you drive such as your daily commute.

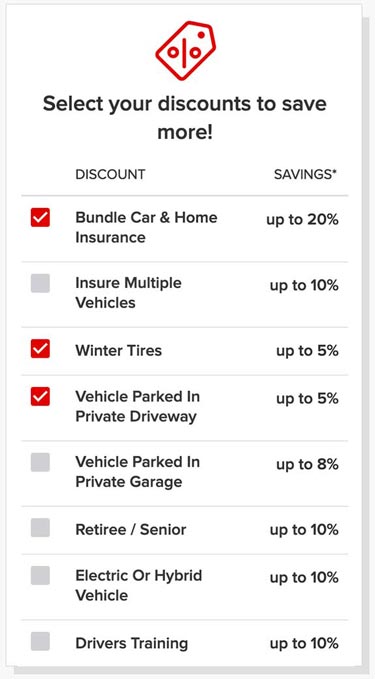

Let us know about the insurance discounts that apply to you. We’ll ensure you take advantage of all eligible discounts for even more savings. Depending on your situation, you could save 20% or more on discounts alone.

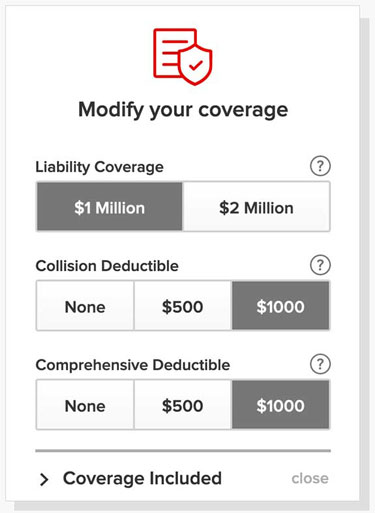

Adjust your coverage and deductible amounts to a level you are comfortable with. Your selection will affect the price.

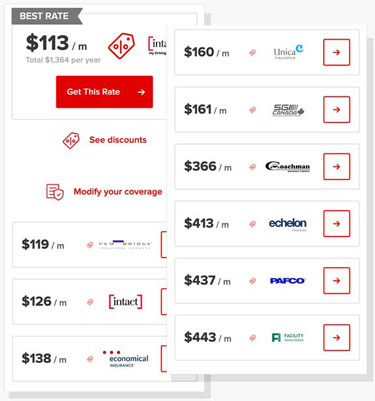

Choose from a list of providers. Choose the plan and price that best meets your needs.

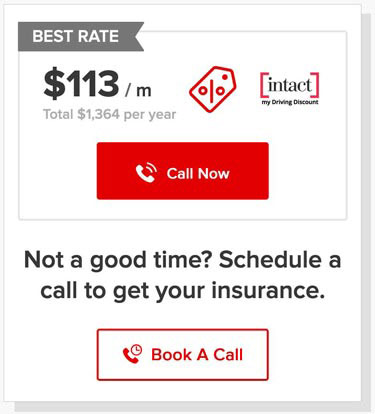

Speak with an advisor to secure your price and buy your policy.

Here are some of the main situations when you can use a calculator to check your rates:

Getting the most out of a car insurance calculator is important. It ensures that your estimates are as accurate as possible. Here are some tips to follow the get better estimates with our calculator:

Consider all the variables when choosing your policy to make sure you are getting good value.

Rated 4.7 out of 5 stars in 1463 Google reviews

Thousands of drivers have used our calculator to save on coverage.

See all reviewsAn insurance company uses many factors when calculating your auto insurance rates.

Here are the factors that cannot be used:

An insurance calculator is only as correct as the information you provide. If you leave sections blank or do not enter correct data, your quote will not be accurate. It’s recommended you gather what you need, such as your driver’s license, vehicle information, and driving history before using one.

There is often a misconception that car insurance calculators cost money to use or you need to commit to something to get access to them.

Using our calculator is 100% free.

No, you need to use your personal information. Your address, age, gender, license details and driving history are all used to determine car insurance in Ontario.

Read our insurance blog to get helpful tips, information and news.

Tariffs, the hidden cost in your insurance premium. This blog explains the connection between import taxes, rising repair costs, and your increasing insurance costs.

Thinking of filing a car insurance claim? Want to learn more about the process? Get tips and answers to common questions about auto claims.

Shocking new data reveals Ontario's top 10 cities with the highest car theft insurance payouts. Are you living in a high-risk area? Uncover the surprising results and learn what you can do.

Got caught speeding in a community zone by photo radar? Here's how speed cameras work and if the fines will impact your insurance rates.