How much does car insurance cost in Burlington?

Drivers in Burlington live in a region where they pay just under the provincial average for car insurance. You can expect to pay about $ 1,723 per year for coverage. This is above the national average, but below the provincial average.

Here’s a breakdown of how much you can expect to pay:

- Annually: $ 1,723

- Semi-annually: $ 861.50

- Quarterly: $ 430.75

- Monthly: $ 143.58

- Weekly: $ 33.13

- Daily: $ 4.72

Rates are based on ThinkInsure customer quote data for Q1 2024 (Jan 1 to March 15, 2024)

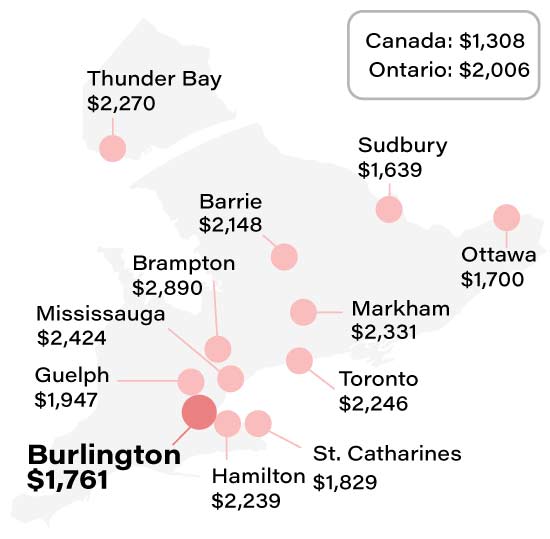

Burlington auto insurance premium map

Sources: *FSRAO

2023 ThinkInsure customer quote data. Drivers with a clean driving record and standard coverage

Burlington car insurance rates from 2019-2024

Premiums are increasing in Burlington, like many other cities in the province. The ever-changing nature

of insurance rates means they are subject to frequent adjustments, based on insurers' analysis of data

regarding claims, repair costs, accidents, and various other factors. Furthermore, your driving record and

potential qualification for supplementary discounts can impact these rate variations. See how rates have

changed over the past few years:

| Year |

Average annual premium |

| 2024 |

$ 1,723 |

| 2023 |

$ 1,647 |

| 2022 |

$ 1,826 |

| 2021 |

$ 1,765 |

| 2020 |

$ 1,880 |

| 2019 |

$ 1,749 |

| Average rate (2019-24) |

$ 1,765 |

**

Burlington auto insurance premiums by driver type

Your auto insurance payments are influenced by your driver profile. Elements like age,

demographics, driver classification, and driving record factor into the calculation of your premiums by

insurance companies. To understand how these factors impact your payments, we analyzed our

customer quote data. Here is what we found about how much drivers in Burlington pay for insurance:

| |

Premium |

Monthly |

Difference |

| Driver type |

| All drivers |

$ 1,945 |

$ 162 |

0 |

| Young drivers (25 and under) |

$ 2,710 |

$ 226 |

39.33% |

| Middle age (25 - 50) |

$ 2,046 |

$ 171 |

5.19% |

| Mature/senior drivers (50+) |

$ 1,322 |

$ 110 |

-32.03% |

| High risk drivers |

$ 5,277 |

$ 440 |

171.31% |

| Demographics |

| Male |

$ 2,010 |

$ 168 |

3.34% |

| Female |

$ 1,819 |

$ 152 |

-6.48% |

| Married |

$ 1,760 |

$ 147 |

-9.51% |

| Single |

$ 2,103 |

$ 175 |

8.12% |

| Driving record |

| Clean driving record |

$ 1,945 |

$ 162 |

0 |

| 1 ticket within the past 3 years |

$ 2,103 |

$ 175 |

8.12% |

| 1 accident in 3 years |

$ 2,571 |

$ 214 |

32.19% |

| 1 cancellation in 3 years |

$ 2,598 |

$ 217 |

33.57% |

| 1 suspension in 3 years |

$ 2,100 |

$ 175 |

7.97% |

*****

Auto insurance rates in Burlington compared to local cities nearby

How does Burlington stack up against similar cities? Pretty well actually. Rates are in the middle of the pack. See how they compare:

| City |

Avg premium |

| Hamilton |

$ 2,291 |

| Milton |

$ 2,184 |

| Oakville |

$ 2,106 |

| Burlington |

$ 2,002 |

| Brantford |

$ 1,784 |

| St. Catharines |

$ 1,734 |

| Grimsby |

$ 1,406 |

****

What areas in Burlington have the cheapest car insurance?

Your insurance rates can be influenced by the area of residence within a city. In Burlington, the difference between postal codes could lead to a difference of about $400 or more. If you are contemplating a move, this is an important aspect to consider. See the difference by postal code in Burlington below:

| Area in City of Burlington |

Postal Codes |

Avg Premium |

| La Salle, Indian Point, Bayview, Aldershot |

L7S, L7T |

$ 2,087 |

| Port Nelson, Dynes, Roseland, Glenwood Park, Clarksdale, Mountain Gardens |

L7R, L7P, L7N |

$ 2,122 |

| Northeast Burlington |

L7L |

$ 1,670 |

| North Burlington |

L7M |

$ 1,872 |

***