What is the average cost of car insurance in Ottawa?

![cars driving in downtown Ottawa with Ottawa river]()

The nation's capital is one of the biggest cities in the province. Many drive to get around the city, and there is considerable traffic. This is reflected in how much residents pay for insurance.

The average car insurance cost in Ottawa is $2,025. This is nearly $300 more expensive than the provincial average of $1,737. However, it's about $300 less than car insurance in Toronto.

Rates are based on ThinkInsure customer quote data for Q1 2024 (Jan 1 to March 15, 2024)

How much is car insurance per month in Ottawa?

Using the average cost of $2,025, your monthly premium would be about $168 per month.

Here’s how different time frames break down Ottawa auto insurance premiums:

- Annually: $2,025

- Semi-annually: $1,012.50

- Quarterly: $506.25

- Monthly: $168.75

- Weekly: $38.94

- Daily: $5.55

Ottawa car insurance rates from 2019-2024

Insurance rates change frequently. They change based on data collected by insurers about claims, repair costs, accidents, and many other considerations. They also change based on your driving record and if you qualify for additional discounts.

In general, auto insurance costs in the city are on an upward swing. By how much is the question? So, we compared quotes we’ve received from drivers to see how premiums change over time. As you can see in the chart below, rates have increased by over $350 per year since 2019. Below you’ll see how prices fluctuate each year:

| Year |

Avg premium |

| 2024 |

$ 2,025 |

| 2023 |

$ 1,770 |

| 2022 |

$1,794 |

| 2021 |

$1,710 |

| 2020 |

$1,704 |

| 2019 |

$1,663 |

| Average rate (2019-24) |

$ 1,778 |

**

Ottawa auto insurance premiums by driver type

Your driver classification affects how much you pay for auto insurance. Things like your age, demographics, driver classification, and driving record factor into how your premiums are set by insurance companies.

We decided to look at our customer quote data to see how these things affect your payments. Here’s what we found:

- Drivers who are younger (under 25) pay more than more experienced drivers.

- Being in the high-risk insurance category will more than double your payments.

- Mature drivers over 50 have the cheapest rates.

- Men pay more than women and single people pay more than married couples.

- Tickets, accidents, suspensions, and policy cancellations will significantly increase your costs.

| |

Avg premium |

Monthly payment |

% difference |

| Driver type |

| All |

$1,740 |

$145 |

|

| Young (25 and under) |

$2,286 |

$191 |

31% more |

| Middle age (25 - 50) |

$1,45 |

$145 |

0.2% more |

| Mature/senior (50+) |

$1,157 |

$96 |

33% less |

| Substandard |

$3,661 |

$305 |

166% more |

| Demographics |

| Male |

$1,772 |

$148 |

2% more |

| Female |

$1,675 |

$140 |

4% less |

| Married |

$1,699 |

$142 |

2% less |

| Single |

$1,795 |

$150 |

3% more |

| Driving record |

| 1 ticket with past 3 years |

$2,949 |

$246 |

69% more |

| 1 at-fault accident in 3 years |

$3,368 |

$281 |

94% more |

| 1 cancellation in past 3 years |

$3,249 |

$271 |

87% more |

| 1 suspension in 3 years |

$3,485 |

$271 |

% more |

***

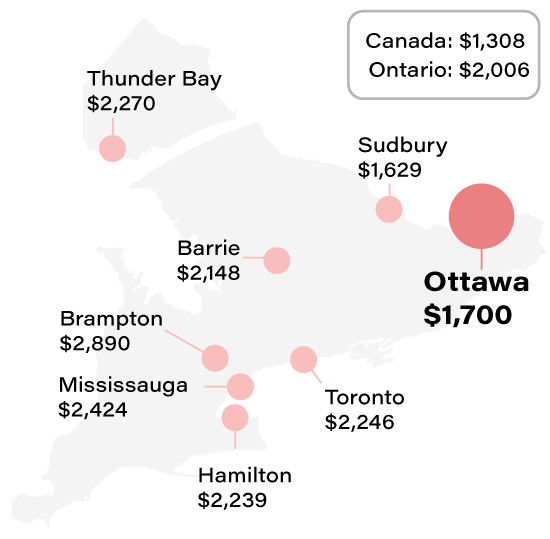

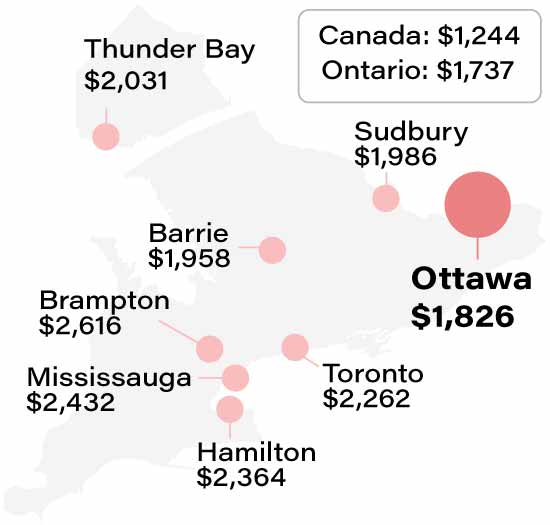

Ottawa car insurance rates vs. other big cities

Ottawa is known for its safe roads and car insurance rates reflect this fact. Insurance is generally less than in other regions in the province. In some instances, you will pay hundreds of dollars less per year than in the GTA, for example.

Below is a comparison of prices with other large cities in the province*.

Sources: *FSRAO

2023 ThinkInsure customer quote data. Drivers with a clean driving record and standard coverage

Auto insurance rates in Ottawa compared to local cities nearby

Even though Ottawa is one of the most affordable big cities for car insurance in Ontario, it’s still higher compared to smaller towns and cities in the region. As you can see in the chart below, where you live within Eastern Ontario can affect how much you pay by hundreds of dollars per year.

| City |

Avg premium |

| Ottawa |

$1,740 |

| Brockville |

$1,555 |

| Kingston |

$1,515 |

| Smith Falls |

$1,459 |

| Cornwall |

$1,349 |

| Bancroft |

$1,237 |

| Hawkesbury |

$1,208 |

| Perth |

$1,144 |

| Pembroke |

$1,113 |

****

What areas in Ottawa have the cheapest car insurance?

Where you live within a city can affect how much you pay for insurance. The difference between postal codes in Ottawa could be hundreds of dollars per year. It's something to consider if you are planning on moving.

Car insurance rates typically are cheapest if you live in Napean and the surrounding area with an average cost of $1,646 per year. This includes Blossom Park, Greenboro, Leitrim, and Findlay Creek.

The most expensive neighbourhood is the Gloucester area (Blackburn Hamlet, Pine View, and Sheffield Glen) with premiums of around $1,829 per year.

Below is an example of how rates vary throughout the city:

| Area |

Postal code |

Avg rate |

| Gloucester |

K1B, K1T, K1X |

$1,829 |

| Ottawa |

K1G, K1K, K1S, K2C, K1J, K1H, K1V, K1A, K1N, K1P, K1R, K1Y, K1Z, K2A, K2B, K2P |

$1,657 |

| Manotick |

K4M |

$1,646 |

| Napean |

K0A, K2G, K2H, K2J, K2R, K2E |

$1,634 |

| Vanier |

K1L |

$1,623 |

| Barrhaven |

K2J |

$1,616 |

| Kanata |

K2K, K2L, K2M, K2T, K2V, K2W |

$1,555 |

| Orleans |

K4A, K1W, K1E, K1C |

$1,458 |

| Stittsville |

K2S |

$1,370 |

| Rockcliffe |

K1M |

$1,351 |

| Cumberland |

K4C |

$1,320 |

| Greenly |

K4P |

$1,048 |

***

Ottawa car insurance premiums by vehicle brand and model

The type of car you drive can have a big impact on how much you pay. Some brands are known for being cheaper for insurance because of their safety rating, lower repair costs, and many other considerations.

Car insurance rates by brand

Here are the average premiums for the top vehicle brands. Chevrolet and Subaru top the list with the lowest rates.

| Vehicle brand |

Average premium |

Monthly payment |

| Chevrolet |

$1,324 |

$110 |

| Subaru |

$1,430 |

$119 |

| Volkswagen |

$1,473 |

$122 |

| Nissan |

$1,524 |

$127 |

| Toyota |

$1,620 |

$135 |

| RAM |

$1,633 |

$136 |

| Mazda |

$1,639 |

$136 |

| Lexus |

$1,649 |

$137 |

| Kia |

$1,671 |

$139 |

| Ford |

$1,681 |

$139 |

| Dodge |

$1,716 |

$143 |

| GMC |

$1,779 |

$148 |

| Hyundai |

$1,820 |

$151 |

| Honda |

$1,853 |

$154 |

| Jeep |

$1,860 |

$155 |

| Tesla |

$2,136 |

$178 |

| BMW |

$2,158 |

$179 |

| Mercedes |

$2,369 |

$197 |

| Audi |

$2,541 |

$211 |

***

Car insurance rates by vehicle model

Vehicle brand matters, but so does the model you choose. Here is an overview of rates for popular vehicles with the Prius having the cheapest premium.

| Vehicle models |

Average premium |

Monthly payment |

| Toyota Prius |

$1,307 |

$109 |

| Nissan Rogue |

$1,414 |

$118 |

| Toyota RAV4 |

$1,500 |

$125 |

| Nissan Sentra |

$1,585 |

$132 |

| Ford F 150 |

$1,591 |

$133 |

| Kia Forte |

$1,709 |

$142 |

| Mazda 3 |

$1,757 |

$146 |

| Toyota Corolla |

$1,782 |

$149 |

| Hyundai Elantra |

$1,869 |

$156 |

| Honda Civic |

$2,146 |

$179 |

***